We live in perilous and paradoxical times. Just two months ago, the American economy was experiencing its longest continuous expansion in recorded history. The unemployment rate sat at multi-decade lows, with substantially more job openings than people unemployed, and wage growth was accelerating. The stock market had reached record highs, consumers were confident, and national wealth had raced ahead to a record of $106 Trillion. Despite this apparent prosperity, attacks on our capitalist system were growing ever-louder, and until recently a self-proclaimed “Democratic Socialist” was seriously contending for the Democratic Party’s presidential nomination.

With this rising crescendo of criticism, it is increasingly obvious that maintenance of the status quo is untenable. But the nature of our intervention is not predetermined. Rather than stifling the market with price controls, mandates, and massive government spending, we can harness market forces by adjusting incentives to achieve better outcomes. Implementing a wage subsidy for low-income workers is one such solution. A wage subsidy, which could be implemented at relatively modest cost and gain bipartisan support, would strengthen the labor market, reduce income and wealth inequality, and increase America’s economic competitiveness in global markets.

Moreover, a wage subsidy would be a superior solution to alternatives such as an expanded Earned Income Tax Credit (EITC), an increased minimum wage, a federal jobs guarantee, a reinvigorated industrial policy, or universal basic income (UBI) thanks to its simplicity, universality, potential bipartisan appeal, the immediacy of benefits, reasonable cost, and lack of incentive distortions that deter work, hiring, and investment.

That we’ve witnessed increasing calls for government intervention in the economy should not be surprising. Peering between the cracks of our apparent prosperity reveals a troubling bifurcation of outcomes. Income and wealth inequality had risen dramatically, labor force participation remained near its post-recession low, economic gains had been highly concentrated by geography, and huge swaths of America were still reeling from a decades-long hollowing out of America’s industrial core.

Socio-economic mobility had declined substantially, suggesting that the “American Dream” was no longer realistic for many. Accompanying these trends, suicide rates and drug overdoses rose to record highs, led by the people and regions that have been left behind economically. For too many, especially low-skilled workers and their families, life in America was animated not by prosperity and hope but by despair.

Then came COVID-19.

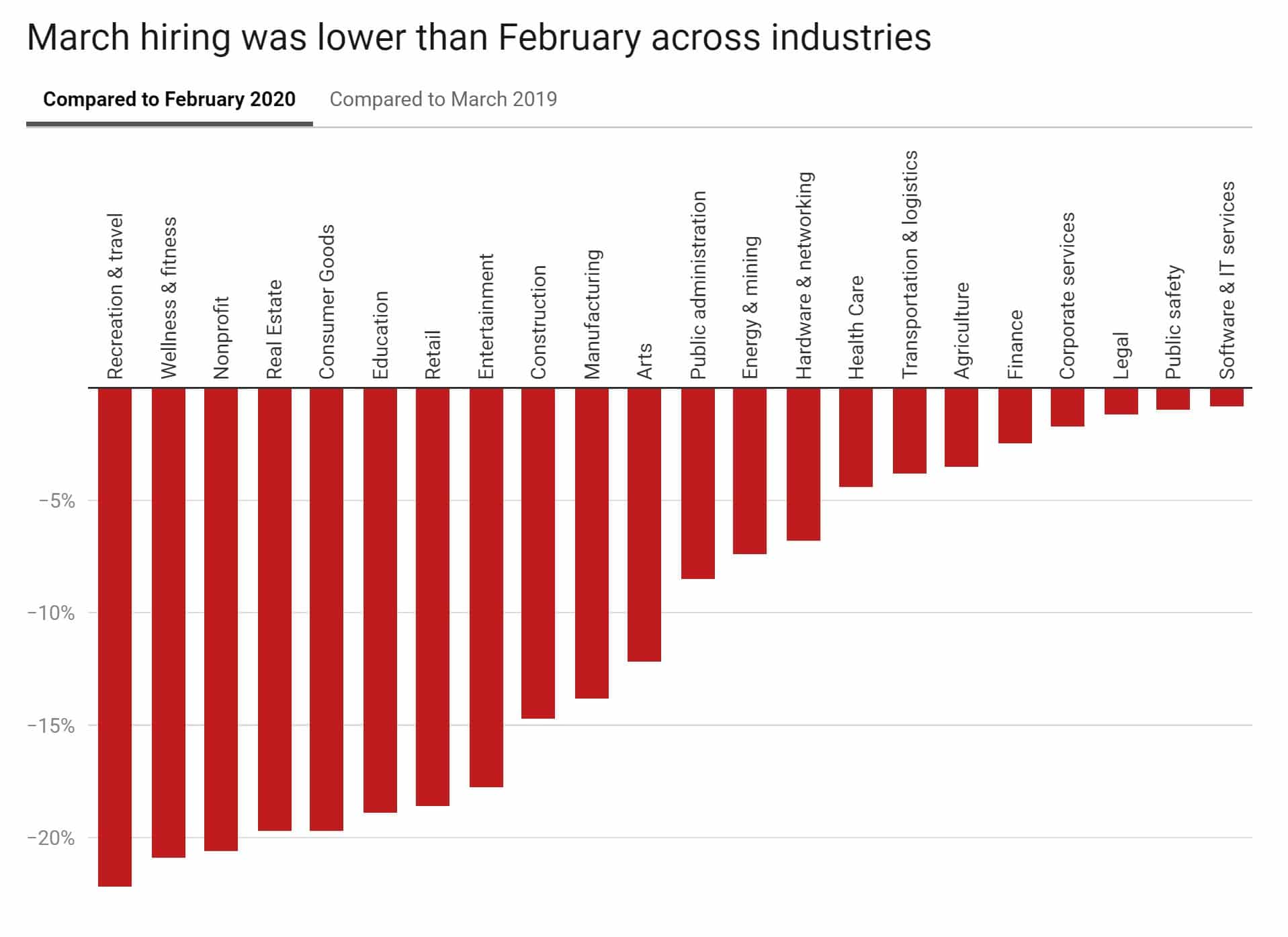

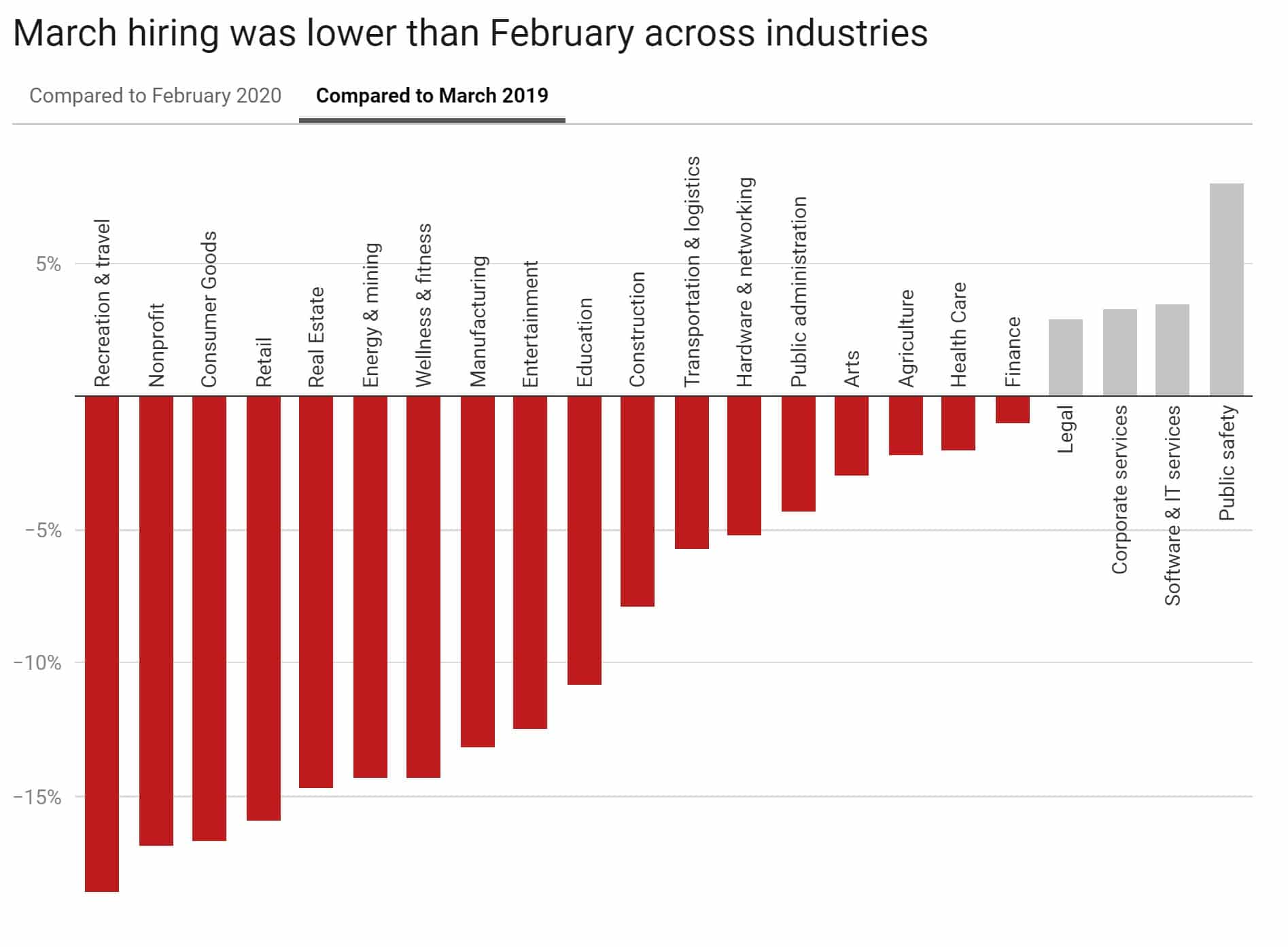

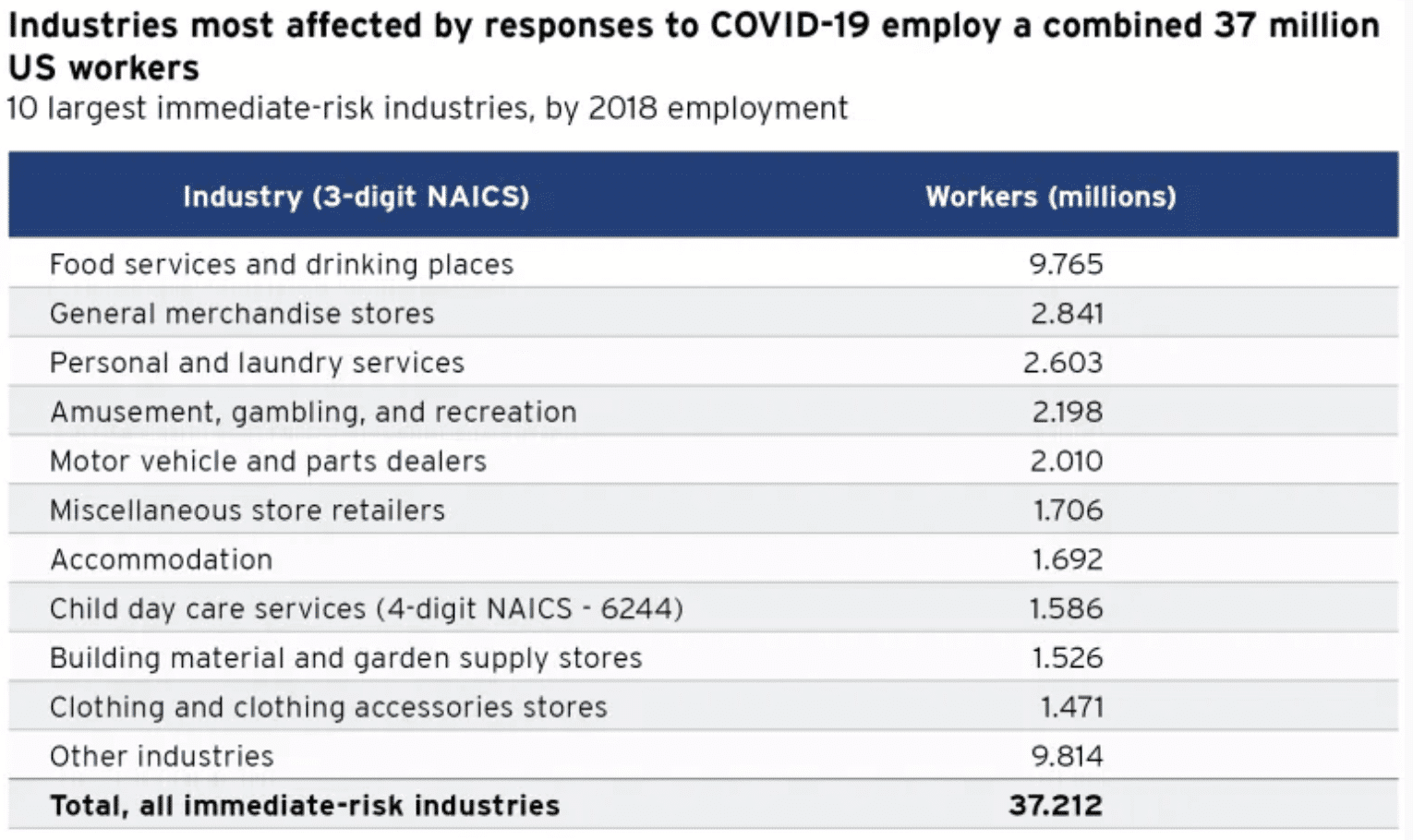

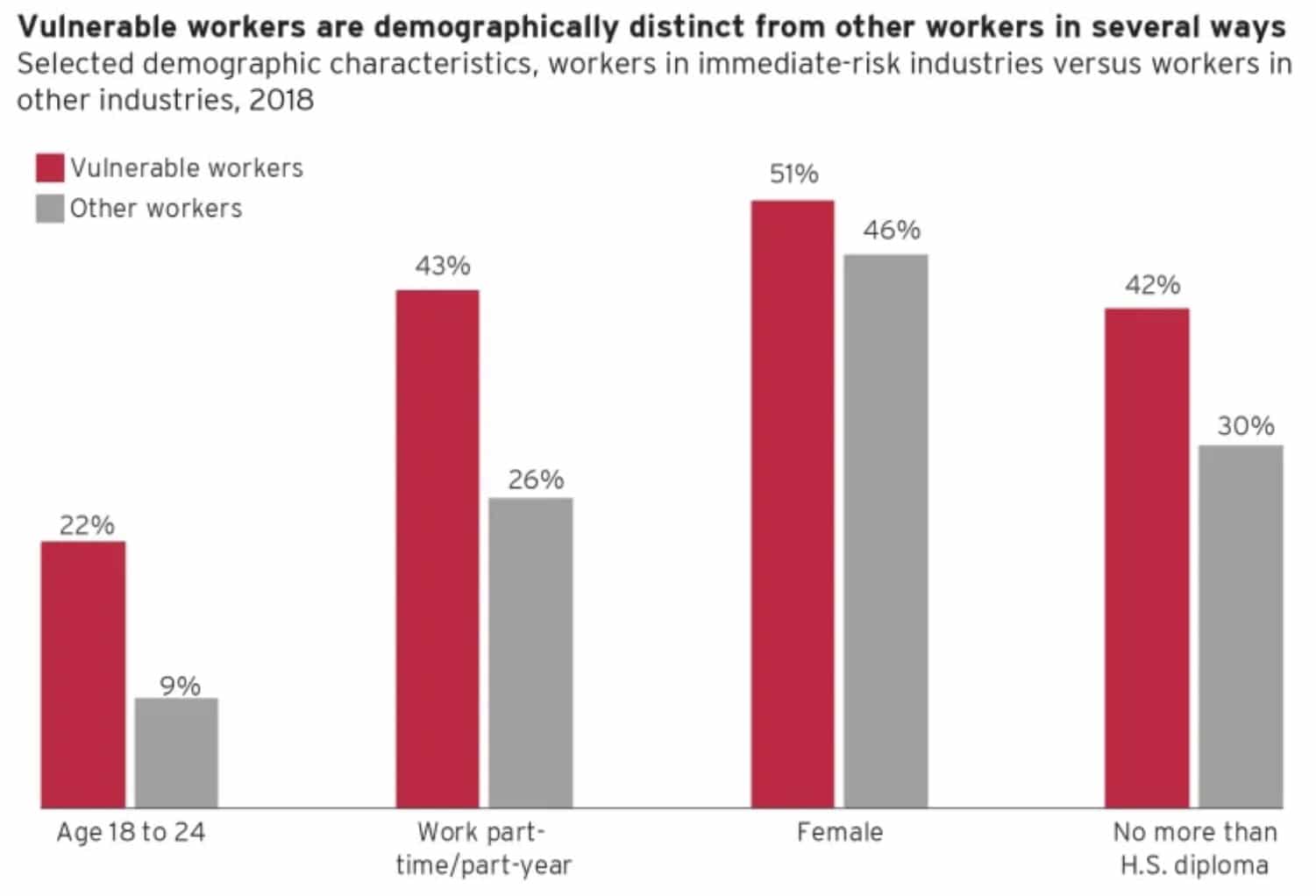

Since the virus’s arrival on U.S. shores, life in America has changed dramatically. Today, most Americans live under “stay at home” orders, and must practice “social distancing” when in public. More than 600,000 Americans are known to have contracted the virus, and over 30,000 have perished—figures that continue to increase rapidly and likely underestimate the actual toll. Over 22 million Americans have filed initial jobless claims in just the last four weeks. Unsurprisingly, low-wage jobs and industries being hit hardest (see tables/charts below), as small businesses often do not have the cash to retain staff in the face of declining consumer demand and fewer low-wage workers are able to work remotely.

Source: Vox

Source: Brookings Institution

The government has attempted to step into this breach. The Federal Reserve has undertaken unprecedented actions to stabilize credit markets and ensure financing is available for solvent but illiquid firms, while Congress and President Trump have approved in excess of $2 trillion of stimulus to support businesses, households, and the healthcare sector—most significantly, by passing the Cares Act.

Despite this relief, economists are predicting a deep, though they also hope short, recession. JP Morgan Chase, for instance, predicts that the U.S. GDP will contract by 40 percent in the second quarter, with unemployment exceeding 20 percent.

It is obvious that economic recovery is primarily dependent upon an effective public health response to COVID-19, but even before the current crisis, it was clear that the economy was not producing enough family-supporting jobs in the places where people seek them. The dislocations of the pandemic make this failure more acute and highlight the imperative of finding a solution. It is in this context that we should consider the utility of a wage subsidy.

A wage subsidy is very explicitly a distortion of labor markets, so it’s important to examine why this is justified. There are tremendous positive externalities to employment for workers, their families, and their communities. These externalities include improved mental and physical health, higher rates of family formation and stability, improved outcomes for children, decreased crime rates, increased civic participation, opportunities to develop human capital, and improvement across broader measures of community health. Absent intervention, labor markets do not internalize these benefits and therefore do not achieve the best outcomes for society. The main objective of implementing a wage subsidy is to correct this imbalance by incentivizing work by and employment of low-skilled workers. In addition to its impact on the labor market, a wage subsidy also serves to redistribute wealth within the economy from the “haves” to the “have-nots” in a way that incentivizes rather than disincentivizes work.

The mechanics of a wage subsidy are straightforward. First, the government sets a target wage. Employers and employees interact in labor markets as normal, except that the worker’s wage is supplemented to make up a predefined portion of the difference between it and the target. For example, suppose the target wage is set to $15 per hour and the subsidy to 50 percent of the difference, as Manhattan Institute economist Oren Cass has proposed. If a business hires a new employee at a wage of $10 per hour, the employee will actually receive $12.50 per hour in income ($10 + ½ * (15-10)).

The wage subsidy applies to every hour worked and is reflected on his pay stub along with taxes and other deductions as a “Federal Work Bonus,” “Federal Wage Subsidy,” or a similar name. If he later received a $1 raise to $11 per hour, the amount of the subsidy would decline from $2.5 to $2, thus diminishing but not removing the benefit of the raise.

The subsidy would not be targeted, but instead would apply to anyone employed in jobs paying below the target wage or its salaried equivalent—including individuals choosing to work a second job to supplement income. Implementation could be simplified by leveraging existing payroll systems used for deducting taxes and other items from employees’ compensation to add the subsidy each pay period. The program could be piloted by states, with insights from these programs used to optimize program efficacy and minimize scope for fraud. Ultimately, the target wage could be set at the national level, or, like with the minimum wage, it could vary from state-to-state to account for differences in median wages and cost-of-living.

The logic for implementing a wage subsidy largely parallels that of the existing EITC—work is desirable, and people should be encouraged to engage in it. The EITC is a refundable tax credit that is paid to workers who have earned income below a certain threshold, after which the benefits phase-out. In practice, this results in many low-income workers paying very low or negative federal income taxes, effectively subsidizing their employment. A wage subsidy makes several key design changes to improve efficacy.

First, whereas the benefits of EITC are received long after the behavior which earned them and are calculated via an opaque formula, a wage subsidy is received immediately, and the amount is transparent to the worker. This maximizes the incentive effect on the decision to work and provides more financial stability for recipients. Secondly, eligibility for the EITC is dependent upon factors including marital status, the presence of children, and overall household income.

Thus, even if workers associate the benefits of EITC with their choice to work, there are negligible incentive effects for some such as those who are single, without children, or near the income threshold for EITC phaseout. This is defensible for the goal of poverty alleviation but is counterproductive to the goal of achieving increased employment. A wage subsidy applies to all workers and is only dependent on the wage being paid.

Lastly, the complex eligibility requirements of the EITC create significant compliance costs, uncertainty about benefits to be received, and result in frequent payments to ineligible beneficiaries—estimated by the IRS to account for fully 25 percent of program cost in 2018. The wage subsidy’s simplicity, universality, and lack of dependence on non-wage factors minimizes these costs.

Other proposals differ more fundamentally.

A significant increase in the minimum wage, for example, seeks to increase the compensation for low-skilled workers by mandating a price floor rather than stimulating the formation of employer-employee relationships. The predictable result is decreased aggregate employment, decreased investment in labor-intensive industries, and an increase in automation and investment in less labor-intensive sectors. The most marginal workers, including those without a high school diploma, with a criminal record, subject to racial bias, or with other adverse factors are most vulnerable to this drop in employment opportunities.

A federal jobs program offers the promise of employment to the unemployed. Any such program, however, would require a massive bureaucracy to administer, be extremely expensive, and divert human capital away from economically productive industries.

A renewed industrial policy to support manufacturing in the United States has been proposed by some to protect American working-class jobs, and this may be prudent for key industries in our medical supply chains or related to national defense. But such a program would necessarily be subject to lobbying and other rent-seeking behavior by specific firms or industries and is not likely to contribute to a broad-based rejuvenation of work prospects.

A so-called universal basic income (UBI), like other direct transfer programs, could help to alleviate poverty, but it would do little to improve the job prospects of low-skilled workers, be prohibitively expensive, and, even worse, it disincentivizes work on the margins.

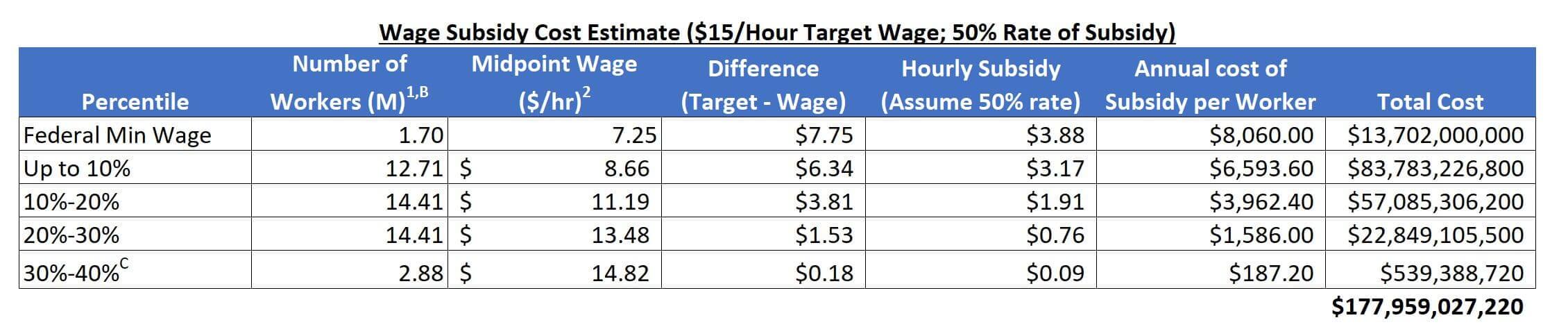

The cost of a wage subsidy is reasonable when compared to its associated labor market impact, the cost of pre-existing poverty alleviation programs, and the specter of alternatives. Total existing transfer payments in 2017 amounted to $2.87 trillion, of which $357 billion consisted of safety net programs for low income or disabled Americans. Based on Social Security Administration data of population by income level, Oren Cass has estimated an annual cost of $200 billion for a wage subsidy with a $15 target. This includes subsidies for existing workers and an estimate of new workers entering the labor force.

Our estimates, based on data from the Bureau of Labor Statistics and the Economic Policy Institute (see below), conclude that the annual cost comes to roughly $180 billion. This is a static estimate that ignores the likely increase in the number of people employed, but also neglects to consider the countervailing savings from reduced spending through other means-tested benefit programs which no longer will be needed. About $70 billion is spent annually on the EITC, so assuming this program is replaced by a wage subsidy the incremental cost would be $110 billion based on our calculation ($130 billion per Oren Cass). While this spending is significant, it pales in comparison to the trillions of dollars per year required to implement UBI.

The application of a wage subsidy would directly impact the labor market for low-skilled workers in a way that increases the total level of employment. By increasing the wage workers receive, more workers will enter the market. This will put downward pressure on market wages paid by employers. The availability of more workers and the reduced cost to employ them will result in employers providing more jobs. The potential for a wage subsidy to benefit employers appears problematic, especially for the prospect of gaining support from left-leaning politicians, but data suggests that roughly 75 percent of benefits accrue to workers, and this dynamic already exists in the case of the EITC which has garnered bipartisan support.

In any case, employers benefiting is a necessary precondition for their willingness to increase employment that would not exist without subsidy. This breakdown of who benefits financially from the subsidy would be determined by relative elasticities of supply and demand in the low-skilled labor market—that is to say, for a given change in wage, how much more labor will be supplied by workers, compared to how much more will be demanded by employers. For workers, estimates suggest that the income elasticity of supply ranges from 0.1-0.3, indicating that for a 10 percent increase in take-home pay, we would expect to see a 1-3 percent increase in hours worked by existing workers and in new workers entering the labor force. This relative inelasticity suggests that much of the benefit would, in fact, accrue to workers. Irrespective of the financial breakdown of benefits, workers, and society would also benefit from the significant positive externalities of employment discussed above.

A wage subsidy is not an elixir. Ideally, its implementation would be combined with other reforms including less restrictive licensing, skewing immigration towards high-skilled workers, improved vocational training programs to match workers with opportunities, streamlined environmental and regulatory permitting for major projects, strongly enforced work requirements for able-bodied recipients of other safety net programs, and removal of inflated credential and education requirements for many jobs. Even then, significant disparities in economic opportunities and outcomes are likely to persist.

Nevertheless, a wage subsidy would be an important step in the right direction. It expands opportunities for low-skilled workers in America to get on the first rung of the economic ladder, rewards them more once they’re there, and facilitates their trajectory towards a brighter future.

A wage subsidy would help accelerate our recovery from the current crisis and restore hope and dignity to the millions who feel disenfranchised today. It would help restore civic institutions and social stability, and reduce the appeal of damaging alternatives that, despite the best of intentions, promise to damage the future economic prospects of intended beneficiaries and of the United States of America.