It is fashionable to refer to the job market of the future as “the gig economy.” In this enlightened, technology enabled wonderland, everyone will be free to balance work and leisure as they see fit. When they want to earn more money, they get online, find a “gig,” and when the job’s performed the money flows into their checking account. Not quite the utopia of Galt’s Gulch, but tantalizingly closer. The problem with the “gig economy” is the troublesome intervention of reality. Tell an Uber driver who has two hungry children, a wife home with the flu (unable to “gig”), who makes $20 per hour and has no health insurance that he’s living in utopia. You may have to duck.

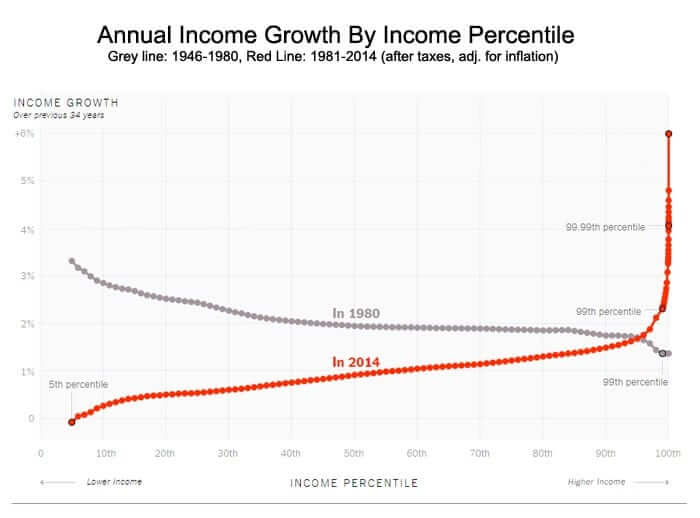

In 2017, the opinion section of the New York Times ran a guest editorial that included a graphic entitled “Our Broken Economy, In One Simple Chart.” That chart was drawn from data gathered by a team of economists that included Thomas Piketty, author of the 2014 bestseller, Capital in the Twenty-First Century. Each dot on the chart below represents an income percentile. They form two lines, the grey line showing income growth by income percentile between 1946 and 1980, and the red line showing income growth by income percentile between 1980 and 2014.

As can be seen, during the 34-year post-World War II period, the lower income groups actually increased their income (on an annual percentage basis) more than did the higher income groups. In stark contrast, during the 34-year-period from 1980 through 2014, the higher income groups did significantly better. So much so, in fact, that a logarithmic scale is necessary after the 99th percentile, showing a dot for every 10th of 1 percent, then another for every 100th of 1 percent, and so on. And it keeps on rising. Between 1980 and 2014, the top 1/1,000th of 1 percent saw their income rise at an annual rate of 5.5 percent, compared to “only” 2.3 percent for the top-1 percent, compared to zero for the bottom 5 percent.

Piketty’s data is interesting, as is one of the central premises of Capital in the 21st Century. “The rate of capital return in developed countries is persistently greater than the rate of economic growth,” he writes, “and that this will cause wealth inequality to increase in the future.” One may argue Piketty’s premise all day, but his focus—and the focus of his acolytes—tends to be on the very highest income earners, along with the very lowest wage earners. Meanwhile, there remains the great American middle class, which labors to earn and retain income against tremendous institutional barriers. Most significantly, the Social Security tax that, as of 2018, is only assessed up to an income of $128,400.

How does this affect an independent contractor? You know, the people who do “gigs.” It all depends on how much the gig pays.

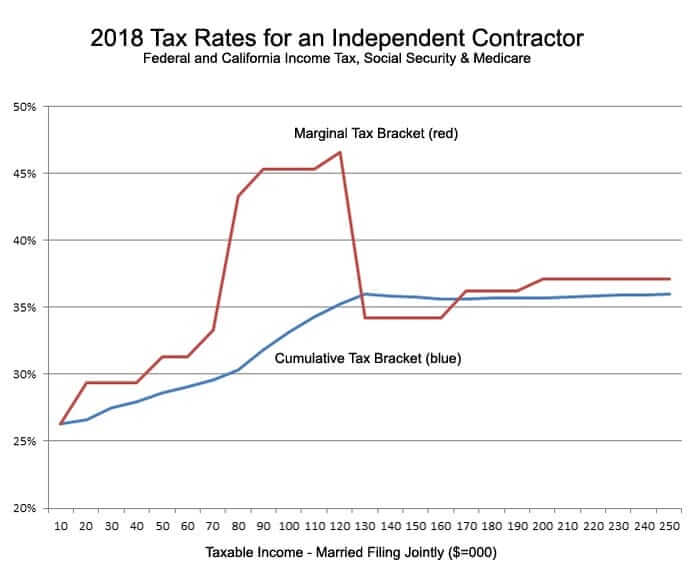

The next chart shows the cumulative and marginal tax brackets by income based on 2018 state and federal tax rates. California’s state tax brackets are applied in this example, because even there, where high-income households pay very high taxes, the burden on the middle class is higher. Using data compiled by the Institute for Social Research and Data Innovation at the University of Minnesota, a household income of $77,400 is in the 59th percentile in America; a household income of $128,400 is in the 80th percentile. Take a look at the marginal tax rate for these households. Between $70,000 and $80,000 it soars from 33 percent to 43 percent, then peaks at 47 percent at 120,000, before plummeting to 34 percent at $130,000. The rapid rise is the impact of the federal income tax rate growing from 12 percent for earnings below $77,400 to 22 percent for earnings above that amount, plus a steady rise in the California state tax rate (6 percent at $64,000, 8 percent at $89,000, 9.3 percent at $112,000). The sudden fall is the result of the Social Security tax of 12.4 percent going away for incomes over $128,400.

It’s valid to question whether we need Social Security, or any government solution to retirement security, but let’s set that aside for a moment and consider what these assessments do to independent contractors, those members of the “gig economy.” In 2018, roughly 70 million Americans lived in households with incomes between $77,000 and $128,000. Not all of them were independent contractors, but if they wanted to supplement their salaried jobs, chances are they were doing that extra work as independent contractors. This is where the marginal tax bracket is so much more relevant than the cumulative tax bracket. The marginal tax bracket shows what individuals in those household income brackets could expect to keep, after they paid all their taxes. Barely more than half. Take a second job that pays $20 per hour? Keep $10.80 after taxes. Take a second job, working nights and weekends, paying $50 per hour? Keep $27 after taxes. Ouch.

The significance of this fact—that upper middle income households pay far less on their extra income than middle income households—has profound implications. People who take on extra work to feed their families, know they’re going to pay not 12 percent federal income tax, but 22 percent (for all income between $77,000 and $165,000), and as an independent contractor they know they’re going to pay 12.4 percent tax for the employer and employee share of Social Security. Add to that Medicare (employer and employee portions), and a high state tax (such as in California), and they know they’ll give back nearly half of what they earn to the government. Crappy gig. But if they’re making over $128,400, they’ll only give back about one-third of what they make to the government. Not a crappy gig.

The implications of this disparity are likely reflected in the attitudes and habits of those who are paying far higher taxes on their extra work. The advantages of working off the books would be hard to resist. The decision to vote for higher taxes on wealthier individuals would be easy to justify. Not depicted on the chart, but worth mentioning, is that once you hit around $165,000 in household income, your taxes don’t increase significantly until you’re making over $400,000 which is where the federal income tax rate jumps to 32 percent. And even in California, the overall marginal tax rate paid by people making under $128,400, 47 percent, is never significantly exceeded, not reaching 48 percent until household income is nearly $700,000. In states without state income tax, the marginal rate (there is no cap on Medicare payments) tops out at 41 percent, well below what people making under $128,000 have to pay.

What might people on either side of this great tax divide think about issues such as immigration and trade? It’s tempting to generalize. The people paying 46 percent on every extra dime they make might wish to see an end to mass immigration of unskilled laborers, since the result of their influx is even higher taxes and lower wages. The higher income people who only pay about one-third of their extra income in marginal taxes might not want to curtail the flow of unskilled migrants, since the more who come in, the less they’ll have to pay for house cleaners and gardeners.

On the question of trade, the people with well-paying manufacturing jobs probably still make less than $128,000 a year, and would like to see fair trade practices. The people making more than $128,000 per year probably have so-called white collar jobs in the “services” sector, relatively immune from globalization. With respect to Piketty’s chart, showing the maddening growth in income inequality between 1980 and today—how much of that had to do with trade and immigration policies? Ideological fill-in-the-blanks answers not accepted.

Coming back to the issue of Social Security, it’s easy to take the libertarian position that everything should go into private accounts. Compounding returns! Market-based! Private sector! Rah rah! But as with so many libertarian fantasies, privatizing Social Security ignores critical factors. To name a few: Social Security mitigates against long-term market risk, whereas private accounts can lead to the complete destruction of savings for an entire generation. Investments perform according to unpredictable long-term cycles, meaning some decades may be far kinder to people living off their investments than others. Social Security also mitigates against mortality risk, wherein some people may outlive their investments, and others may die young and oversave.

There’s more: Social Security benefits— to cross into rank heresy—are progressive, which means it pays higher returns to people who had lower lifetime earnings. And then one must consider the impact of dumping the entire Social Security fund into the global investment markets, exacerbating the already challenging reality of too much speculative money chasing too few high-return investments. Finally, Social Security is not a “Ponzi scheme,” because Ponzi schemes imply a return of principal, nor is Social Security a “Pyramid scheme” because Pyramid schemes require increasing numbers of entrants and therefore must always eventually collapse.

Here’s a better idea. Why not take away the cap on Social Security tax, and use all that extra money to make Social Security forever solvent? At the same time, why not decide once and for all who is a U.S. citizen and stick to that, so Social Security benefits aren’t diluted by payments to people who didn’t contribute to the system their entire life? And while we’re at it, why not liquidate public employee pension funds, and convert all public employee retirement benefits to Social Security (and Medicare), so that every citizen in the United States faces the same set of challenges and opportunities?

Whether or not the “gig economy” is a desired feature of the brave new world we’re entering largely depends on just how much that “gig” is paying. Because if their extra gig puts them into a marginal tax bracket that’s under $128,400, they owe the government nearly half the money they make from their “gigs.” But if they make more than that, they actually pay far less in taxes.

A fitting, if somewhat ambivalent way to sum this up would like this: Make America’s tax system fair, so that no matter how much you make, you pay the same percentage of your income into Social Security, or, get rid of Social Security entirely. As long as 70 million Americans are paying more in taxes than the people who make more than them have to pay, it is a farce to tout the gig economy as part of an inevitable and desirable future.

Content created by the Center for American Greatness, Inc. is available without charge to any eligible news publisher that can provide a significant audience. For licensing opportunities for our original content, please contact licensing@centerforamericangreatness.com.

Photo Credit: Getty Images